Those who want to invest in real estate to protect their investments from inflation can do so by contributing to residential real estate, like buying an apartment or incrementally investing in office buildings and shopping centres via real estate funds.

So, you don’t need to have a lot of spare money to start investing nor does investing in real estate mean you have to buy an apartment first.

Specialised funds – for instance, the Baltic Horizon Fund, the first certified business real estate fund with a reasonable credit burden – is a suitable choice for anyone who wants to take part in the business of business real estate but who may not have enough money to individually purchase business real estate. And even people who have the opportunity to invest in an office building or a shopping centre might not wish to be dependent on a single property or location.

Baltic Horizon is an evergreen fund that was certified in 2016 at both the Nasdaq Tallinn and Stockholm stock exchange. The fund owns mainly office buildings as well as shopping and community centres in the most lucrative locations at the hearts of major cities in the Baltics.

Baltic Horizon Fund’s fund manager Tarmo Karotam says that real estate is considered an asset class with a strong buffer against inflation and a low correlation between stocks and bonds. That is why real estate has found a place in many investors’ portfolios as a means of risk mitigation. Also, history has shown that you can expect strong growth in investment in real estate in a city centre depending on the developments in the financial environment.

The fund has thousands of investors

Our investors include many different investors from retirement funds and insurance companies to private citizens who, for example, invest ten euros and do that every month, said Fund Manager Tarmo Karotam.

In total, Baltic Horizon Fund has several thousand investors. When considering different investments it is always important to compare the potential benefits with the accompanying risks. Investment always means taking a risk, especially in tough times such as the current financial instability, inflation and price increase.

Real estate fund portfolios usually consist of buildings with different functions, which in Baltic Horizon Fund’s case are also located in the capitals of the three Baltic States. Therefore, the fund covers different client segments and locations.

The priority is stable revenue for the owners and long-term capital growth

By the end of September, the total consolidated value of the fund had reached nearly 350 million euros. Since being certified at the Tallinn stock exchange in 2016, one of the priorities for the real estate fund is to pay investors investment revenue.

“Despite the turbulent times, our main goal is to keep our real estate attractive for renters and clients so that we can continue paying dividends to our investors,” said Baltic Horizon Fund’s Fund Manager Tarmo Karotam.

The fund’s current strategic priorities are about renewing the concepts of their objects in the city centres and optimising energy use to ensure long-term capital growth.

Renewing helps to increase profits

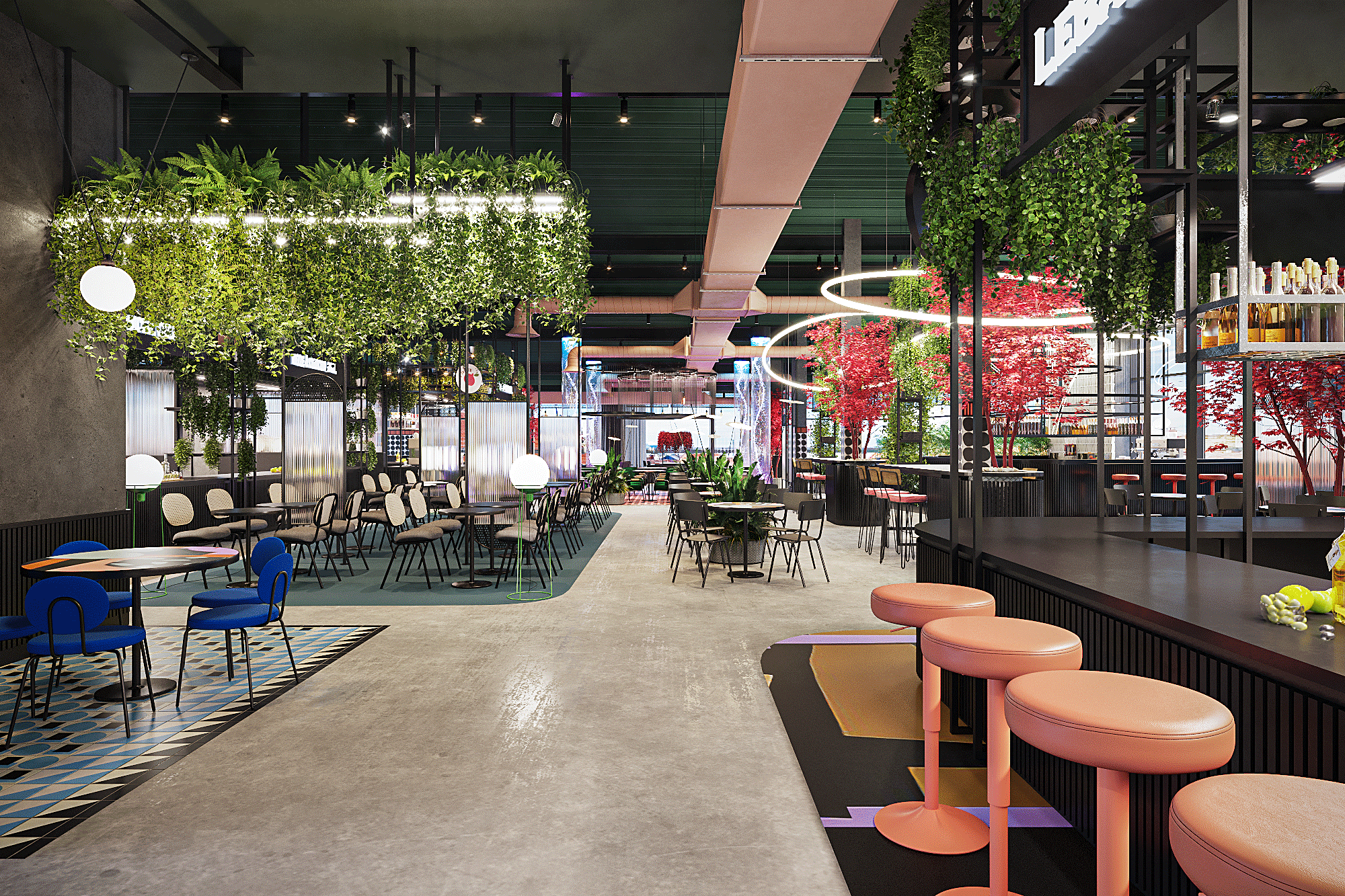

The renovations of the Europa shopping centre in Vilnius was just completed, which ended up costing six million euros. The proposed renewed shopping concept aligns with the clients’ changed consumption habits post-pandemic, some of the keywords being authentic high-quality food and social shopping.

In Latvia, the Baltic Horizon Fund is refreshing the shopping mall Galerija Centrs in Riga’s old town, where clients can enjoy the renewed concept by the end of next year’s first quarter.

Also, the Baltic Horizon Fund has started with the first part of the reconstruction project for Postimaja and Coca-Cola Plaza in Tallinn with a focus on expanding Reval Café onto the main street level. Next, the focus is on the new concept for the Apollo cinema.

Tarmo Karotam said that during the process of expanding Postimaja, Reval Café which was already located there was given a new concept. “The new cafe will surely be a popular meeting place in the city centre,” said the Baltic Horizon Fund’s fund manager.

A part of the fund’s work is hidden from the public

Fund manager Tarmo Karotam emphasised that managing a real estate fund “does not just include renters and bank loans”. There’s actually a lot more, part of which remains hidden from the public.

“All the regulations and the different monitoring agencies and their requirements, making information precise and clear, reporting in a way that’s very clear to the investors,” he said. “There are a lot of little things behind the scene that are actually very important.

As we are certified by both the Nasdaq Tallinn and Nasdaq Stockholm stock exchange, we want to offer investors a liquid investment option, regular dividend support and long-term capital growth,” continued the Fund Manager for the Baltic Horizon Fund, a real estate fund certified by the stock exchange.

Baltic Horizon Fund

- The real estate fund Baltic Horizon Fund invests in business real estate in the capitals of the Baltic States.

- The fund currently owns 15 real estate properties including Postimaja, Coca-Cola Plaza, the Lincona office complex and the Pirita shopping centre.

- The goal is to acquire quality real estate and create increased value in the future through active management.